Use the Trip Optimizer Tool to determine the most cost effective travel solution.

Renting a car through a university-preferred supplier offers well-maintained, low-mile cars at discounted rates for business travel. NOTE: When traveling by car, mileage reimbursement isn’t always the most economical or safest choice.

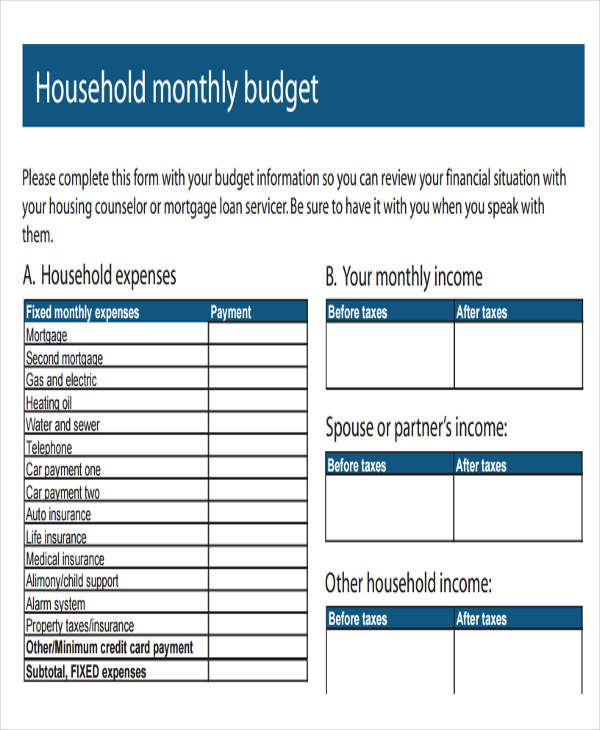

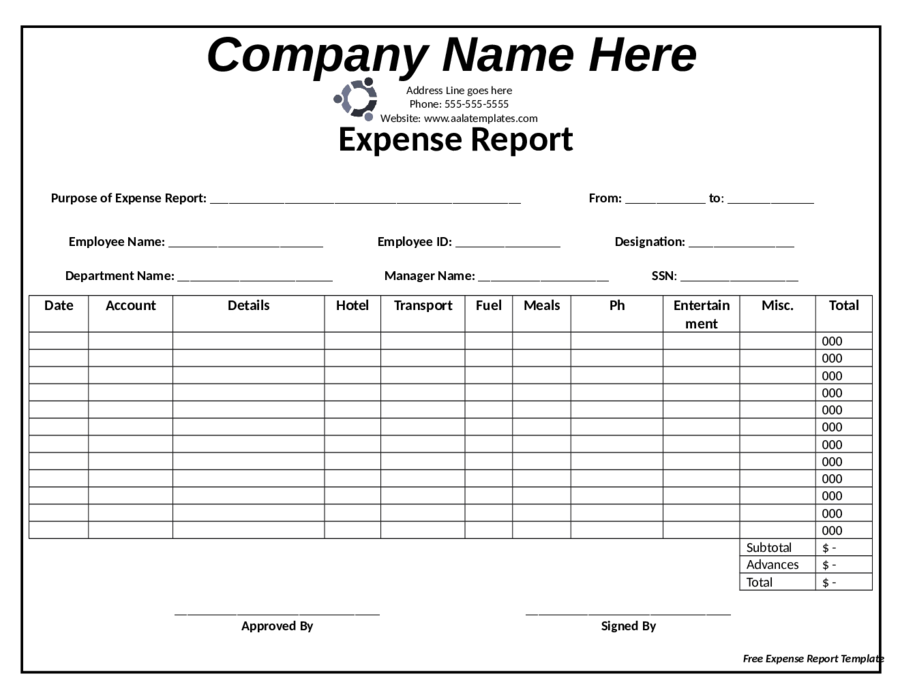

The origin for business travel mileage is computed from the employee’s U-M unit office location or home address, whichever is closest to the destination. Tolls and reasonable parking charges will be reimbursed in addition to the mileage allowance. An expense report is a formal document used by employees and contractors to receive reimbursements for business expenses from their employers. The mileage rate for reimbursement accounts for fuel costs as well as wear and tear to a personal vehicle therefore, costs for fuel or maintenance are not reimbursable. Mileage reimbursement is limited to the amount of the coach airfare. When claiming mileage in lieu of airfare, a coach class comparison from Concur at least 14 days in advance of the trip is required with the expense report submission. Effective January 1, 2023, the mileage reimbursement is 65.5 cents per mile. *The amount to tip is at the discretion of the unit, though generally 15-20% is typical.Īt times, a personal vehicle may be used in order to save time, transport equipment, or reduce costs when several people are traveling together on university business travel. The expense must nevertheless be reasonable from a business standpoint for the type of activity taking place. Bartender or wait-staff fees (not including gratuity)įor development activities involving hosting donors and recruitment activities involving hosting recruits (faculty, staff, or athletics), expenses for meals and alcohol are allowable at the actual amount incurred. The following items are not included in the per-person cost for business hosting: The expenses, including tax and tip*, that exceed the amounts listed above must be segregated and cannot be charged to General or Federal funds. Īny business meal costs that exceed the maximum allowances must be accompanied by a detailed explanation and have approval from a supervisor or higher-level administrative authority. Refer to the university’s policy on Indirect Cost Recovery Excluded (ICRX) Expenditures. Alcohol expenses must be flagged with an “X” Class and cannot be charged to General, Federal, or Sponsored funds. Workday Expenses brings together a user-friendly experience with enterprise-grade functionality.

Business meal expenses, including non-alcoholic beverages, tax, and tip*, should not exceed the maximum per person allowances of $30/breakfast, $30/lunch, and $70/dinner.Įxpenses for alcoholic beverages are limited to $20 per person, per event, including tax and tip*.

0 kommentar(er)

0 kommentar(er)